Last week at Flywheel Coworking, founders and operators filled the room for a conversation many business owners put off too long: how your financial team needs to evolve as your company grows.

Our speakers, Mike Airhart with Accountability Services and David Benner with FocusCFO, have both built and led businesses through growth, complexity, and transition. Drawing from firsthand operating experience, they shared practical insight on when financial structure needs to level up and what happens when it doesn’t.

Here were the biggest takeaways:

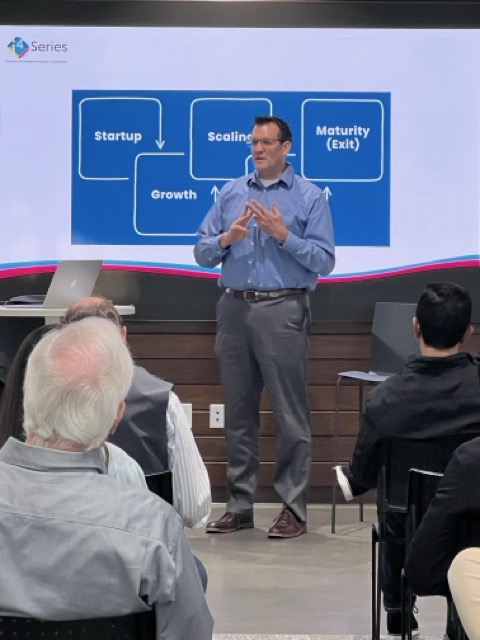

What Got You Here Won’t Get You There

A lot of founders think they understand their numbers. Until growth exposes the gaps. At the early stage, a CPA who handles taxes and basic compliance may be enough. But once you hire employees, manage real cash flow swings, or start thinking about funding, the game changes. The shift isn’t about “more bookkeeping.” It’s about moving from looking backward to looking forward.

Monthly reviews. Forecasting. Strategic tax planning. Real budgets.

David pointed out something that hit home for many in the room: there are plenty of $1M–$5M businesses still operating without a working budget or forecast. And it shows. Growth increases complexity faster than most founders expect.

Watch for Trigger Moments

One of the most helpful parts of the conversation was identifying the moments that should prompt you to upgrade your financial support.

Hiring your first employee.

Crossing $100K or $250K.

Considering a loan.

Thinking about outside investors.

Mike said, “The worst time to meet your banker is when you urgently need money. Banks and investors want a clean, consistent financial story. If you wait until you need capital to get organized, you’re already behind.” Several attendees shared stories about scrambling to clean up books before financing conversations. It’s expensive. It’s stressful and it’s avoidable.

Stop Treating Financials Like Tax Homework

Another theme of the night was that your financial statements aren’t just for the IRS.

When you actually review your numbers monthly, you start to see patterns like seasonal swings, growth ceilings, and cash flow pressure points. You can plan hires before you’re desperate. You can anticipate capital needs instead of reacting to them. Strategic planning turns potential threats into manageable decisions.

David also emphasized something that goes beyond spreadsheets: sustainable growth requires mindset shifts. Delegation. Letting go of control. Bringing in advisory support that matches the stage you’re entering, not the stage you’re leaving. At some point, founders have to stop trying to be their own CFO.

The Bigger Picture

Many in attendance were in that in-between stage – no longer a “startup,” but not yet structured like a mature company. That’s exactly where financial infrastructure matters most. You don’t build an exit strategy the year you want to sell. You build it in the financial systems you put in place years earlier. Strong financial structure creates options and options create leverage.

Thank you to Mike and David for an honest, operator-level conversation and to our i4Series sponsors for continuing to invest in Greenville’s founder community!

Our next event is February 24: Top 5 AI Prompt Frameworks You Can’t Live Without

If you’re not on the newsletter yet, sign up to stay in the loop.

Recent Comments